Sponsored Content

Financial Industry

Vienna Stock Exchange Celebrates Double Success: ATX Reaches All-Time High and CEO Contract Extended

The Vienna Stock Exchange is experiencing a historic day: after 18 years, the Austrian benchmark index ATX reached a new record high at closing on Wednesday. At the same time, the Supervisory Board announced the extension of CEO Christoph Boschan's contract for another five years.

November 26, 2025

Austrian Banks with Capital Reserves Prove Resilient Despite Downturn

Despite Austria's longest, albeit not deepest, recession since World War II, domestic banks are in robust shape. Thanks to high profits in 2024, most of which were retained to strengthen the equity base, the Common Equity Tier 1 (CET1) ratio rose to an impressive 18.6 percent by mid-2025.

November 12, 2025

FACC Recovers Millions Lost in Sophisticated Fraud Scheme: Spotlight on China’s Role in International Asset Recovery

Austrian aerospace manufacturer FACC, based in Ried im Innkreis, has finally recovered €10.8 million, nearly a decade after falling victim to one of the largest corporate fraud cases in the country's history. The case, which involved deceptive emails, impersonation of top executives, and complex international money transfers, not only reshaped the company’s internal controls but also tested the limits of global legal cooperation—especially between Austria and China, where a portion of the stolen money had been frozen for years.

April 10, 2025

Austrian Securities Ownership Reaches New Heights

A recent survey reveals a significant increase in the number of Austrians investing in securities, highlighting a shift towards private pension planning amid economic challenges.

April 9, 2025

Citizens' Initiative Calls for an Austrian State Bitcoin Reserve

A new Citizens' initiative is causing a stir in Austria: A group of Bitcoin enthusiasts is calling for establishing a state Bitcoin reserve worth 2.3 billion euros. The initiators see this as a strategic hedge against inflation and an opportunity to achieve financial independence for the country. However, the project is not without controversy.

February 18, 2025

EAVISTA Takes Over card complete: Bank Austria and RBI Sell Their Shares

The Austrian credit card company card complete Service Bank AG has a new majority shareholder. UniCredit Bank Austria and Raiffeisen Bank International (RBI) have sold their shares in the company to EAVISTA Beteiligungsverwaltungs GmbH.

February 17, 2025

European Commission Sues Seven Member States Including Austria for Failure to Implement the NPL Directive

The European Commission has filed a complaint against Austria and six other EU Member States with the European Court of Justice (ECJ). The reason: these countries have not transposed the EU Non-Performing Loans (NPL) Directive into national law on time.

February 12, 2025

Financial Fraud as a “Growth Industry”: Record Losses and New Scams According to the Austrian Financial Market Authority

The Financial Market Authority (FMA) is sounding the alarm: financial fraud has developed into a real “growth industry”. According to the authority's latest figures, the total loss reported by financial fraudsters in 2024 amounted to around 15.5 million euros - an increase compared to the previous year, when the figure was 12.8 million euros. The dramatic increase in crypto-based fraud cases is particularly worrying. According to the FMA, the majority of these fraud cases could indicate that illegal financial markets are increasingly attracting the attention of criminals.

December 23, 2024

Poland and Austria Network in the Field of Fintech and Finance

The Polish Embassy in Vienna hosted the conference “Poland and Austria: cooperation and exchange of expertise. Fintech and finance” took place. The event brought together many experts, industry representatives, and decision-makers from Poland and Austria. The aim was to network the dynamically growing Polish fintech sector with the stable and well-regulated Austrian financial market and explore potential cooperation areas.

December 18, 2024

Igor Strehl Launches Dunaj Family Office Consulting in Vienna

With the founding of Dunaj Family Office Consulting 24/7 GmbH, Igor Strehl, an experienced expert in the field of financial and real estate management, is establishing a new player in the Austrian consulting landscape. The company, which specializes in investments, relocations, and property management, is positioning itself as a comprehensive service provider and trustworthy partner for private and institutional clients in Austria.

December 2, 2024

Austrian Financial Market Authority Orders Forced Closure of Euram Bank

The Financial Market Authority (FMA) has withdrawn the business license of European American Investment Bank AG (Euram) in Vienna with immediate effect. This follows an extraordinary general meeting at which the bank failed to present a plausible plan for an orderly self-resolution. The bank should have either decided on a capital increase of 25 million euros or presented a credible liquidation strategy.

October 16, 2024

Vienna to Become a Center for Financial Technology: AFT 2024 International Conference

Vienna will once again become the international hub for innovative financial technologies in September 2024. From September 23 to 25, 2024, the sixth edition of the Advances in Financial Technologies (AFT) conference will take place at the Austrian National Bank (OeNB).

September 11, 2024

Wirecard Trial: Further Charges Against Former Management Board Members

Four years after Wirecard's spectacular bankruptcy, the Munich public prosecutor's office has brought charges against two further former members of the Management Board. The focus is on the former CFO, Alexander von Knoop, and Susanne Steidl, responsible for product development.

August 7, 2024

Bank Merger in Carinthia and Burgenland: New Era for Anadi Bank and Bank Burgenland

Following the sale of Anadi Bank to the Grawe Banking Group last December, further details have now been announced. Bank Burgenland will take over 42,000 customers, ten branches, and an SME and real estate loan portfolio from Anadi Bank in September and will operate as Bank Burgenland Kärnten in the future.

August 4, 2024

Austrian National Bank Examined the Spread of Crypto Assets in Austria

Cryptocurrencies such as Bitcoin are widely known in Austria, but their actual distribution in private households remains modest. A recent study by the Austrian National Bank (OeNB) found that only 3% of the population own crypto assets. These few owners usually only hold small amounts, which rarely make up more than a third of their total financial assets.

July 16, 2024

Vienna Stock Exchange Overcomes Challenges in 2023 with Record Bond Listings

The Vienna Stock Exchange experienced a challenging year in 2023, characterized by high interest rates, persistent inflation and geopolitical tensions affecting the European equity markets. Despite these unfavorable conditions, which impacted trading activity, the exchange achieved a record year for bond listings.

January 8, 2024

Austrian National Bank: Monetary Policy Strategies Must Act

In his speech at the opening of this year's Economics Conference, Austria's National Bank - Governor Robert Holzmann shed light on the importance of a robust and resilient monetary policy in uncertain times. Given the recent financial market turmoil, he stressed that monetary policy strategies must not remain empty words and that the instruments must work.

May 24, 2023

Vienna Stock Exchange Reports High Profits for Third-Year Running

Vienna's stock exchange, Wiener Börse AG, has announced high profits for the third year in a row, despite the turbulent economic environment of 2022. Vienna's stock exchange plans to continue its focus on consistent market modeling and alignment with international standards and is calling on the government to act to take advantage of the capital market's potential as a powerful lever.

May 10, 2023

Austria Wants to Bring New EU Anti-Money Laundering Authority to Vienna

Austria is bidding for the seat of the new EU Anti-Money Laundering Authority (AMLA) and wants to bring it to Vienna, Finance Minister Magnus Brunner said. However, it is still unclear whether this is feasible in the current climate of Austrian politics.

March 23, 2023

OPEC Fund Mobilizes $1 Billion for Development Financing

OPEC Fund for International Development mobilizes $1 billion for development finance with "groundbreaking" first SDG bond. The bond was priced based on the Sustainable Development Goals (SDG) bonds, for which Credit Agricole CIB served as the sole sustainability advisor.

January 22, 2023

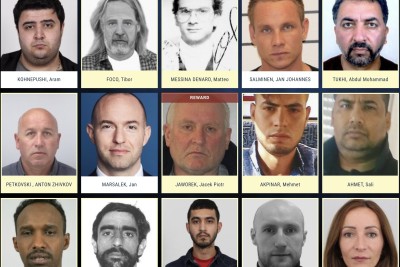

Wirecard Scandal: Trial of Marsalek and other Austrian Entrepreneurs to Begin

The Wirecard criminal trial in what is believed to be the biggest fraud case in Germany since 1945 begins in Munich. The public prosecutor's office accuses the former Wirecard CEO, Austrian Markus Braun, and his two co-defendants of forming a criminal gang, falsifying the group's balance sheets and cheating lenders of 3.1 billion euros

December 7, 2022

Wirecard Scandal: New Indications for Marsalek's Stay in Moscow

Former Wirecard board member Jan Marsalek, who has been in hiding for two years, could be living in Moscow under the protection of Russian intelligence services.

July 26, 2022

Austria's Raiffeisen Bank Now Considering Russia and Ukraine Exit After All

Raiffeisen Bank International is considering withdrawing from Russia. The enormous civil suffering in Ukraine caused by Russia's war of aggression had led the management to this decision. This step is not taken easy, since Russia counts as one of the key areas of the Austrian bank.

March 18, 2022

Russia's Sberbank with European Headquarters in Vienna under Pressure

The Austrian Financial Market Authority (FMA) has announced a moratorium on Sberbank Europe AG, a European subsidiary of the Russian state-owned Sberbank. Read what this means for Sberbank Europe and its customers.

February 28, 2022

Ukraine Crisis: Potential Impact of Russian Invasion on Ukrainian, Russian and EU Economies

The solution of the Russian aggression and violation of rights towards Ukraine, is of central importance for the world we want to live in. The Vienna Institute for International Economic Studies (WIIW) conducted a study on the potential economic impacts of a Russian invasion of Ukraine. Read their prediction for how an invasion would affect the economies of the EU, Russia, and Ukraine.

February 8, 2022 · Updated: February 11, 2022; 08:35

Erste Group Acquires 100% of Commerzbank Hungary

Erste Bank Hungary Zrt. is acquiring Commerzbank’s Hungarian corporate banking subsidiary Commerzbank Zrt. Through this purchase, Erste is strengthening its position in the corporate banking business in Hungary.

December 20, 2021

Wirecard Scandal: Europol Manhunt for Europe's Most Wanted "Marsalek"

Former COO of Wirecard Jan Marsalek, one of Europe's most wanted fugitives, is still the target of an international manhunt for his suspected role in a multi-billion euro fraud scheme. Read about the ongoing search for Marsalek and Europol's 2021 "EU's Most Wanted" campaign.

December 7, 2021

Anadi Bank: Former Deutsche Bank Board Member Becomes New Board Member for FinTech

Alp Dalkilic, a former board member at Deutsche Bank, has been appointed to the Management Board at Anadi Bank. Dalkilic is primarily responsible for the bank's FinTech strategy. Read more about Dalkilic and Anadi Bank.

November 5, 2021

Joint Vienna Institute: Patrick Imam Succeeds Holger Flörkemeier

Patrick Imam joined the JVI - Joint Vienna Institute as Deputy Director. Having joined the International Monetary Fund (a party to the Agreement for the Establishment of the JVI) in 2005, he has held positions in the Middle East and Central Asia as well as the African Department (Zimbabwe and Madagascar), the IMF Institute and the Monetary and Capital Markets division. His predecessor Holger Flörkemeier was the JVI Deputy Director for the last four years. On the occasion of his departure, the JVI interviewed him and asked him to share his experience and views on the JVI.

September 28, 2021

The 250th Anniversary of the Vienna Stock Exchange

The Vienna Stock Exchange recently celebrated its 250th anniversary since it was founded by Maria Theresa. Minister of Finance Gernot Blümel congratulated the stock exchange on its anniversary and advocated for the implementation of a government program and retention periods to incentivize Austrians to invest in the domestic economy. Minister Blümel and Vienna Stock Exchange CEO Christoph Boschan both advocated for educating the public on financial topics. Read more about the Vienna Stock Exchange and what the pair said on its anniversary.

September 14, 2021

What Is the Joint Vienna Institute and What Does It Do?

The Joint Vienna Institute (JVI) is a Vienna based International Organization which provides policy-oriented training primarily to public sector officials from countries in Central, Eastern and Southeastern Europe, the Caucasus and Central Asia, and other selected countries. It has been a hallmark of cooperation between the IMF and Austria for 29 years. Find out how the institute justifies its existence.

July 22, 2021

"Ronaldo of Investment Banking" Becomes New CEO of Bank Austria Parent Company

The Board of Directors of UniCredit SpA, which owns 96.35% of Bank Austria, unanimously nominated "deal junkie" Andrea Orcel as designated CEO to replace the outgoing CEO, Jean Pierre Mustier.

January 31, 2021

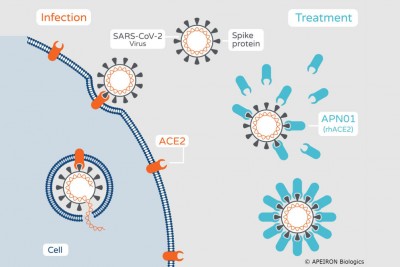

COVID-19 Drug Made in Austria

Austrian biotech company Apeiron Biologics AG, which is currently working on a drug to treat the coronavirus, announces financing round for the further development of the COVID-19 drug APN01.

May 19, 2020

Austria Agrees to ESM Pandemic Crisis Support

The National Council has given its approval for financial aid within the framework of the ESM. Specifically, Finance Minister Blümel was authorized to approve a decision in the ESM Board of Governors to grant corona financial aid to all applicant ESM member states within the framework of the ESM Pandemic Crisis Support.

May 14, 2020

RBI: Significant Decline in Profits in the First Half of 2019

Stock Exchange-listed RBI Raiffeisen Bank International recorded a significant 25% decline in profits in the first half of 2019. The consolidated profit generated was only €571 million, compared to €756 million in the first half of 2018.

August 8, 2019

Forty Tax Offices Become One Tax Office Austria

The structures will be flattened and work processes made more efficient in such a way that 40 authorities will become a single authority with 33 departments at the 79 existing facilities.

April 10, 2019

Facilitated Stock Exchange Access for Small and Medium-Sized Enterprises at the VSE

As a result of an amendment to the Austrian Stock Corporation Act (Aktiengesetz), as of 21 January 2019 it will again be possible for small and medium-sized enterprises and growth companies registered in Austria in the legal form of a stock corporation (AG) with small free float to gain access to the Vienna Stock Exchange via the newly created market segments "direct market plus" and "direct market".

October 19, 2018

Erste Group Expects Q2 Net Profit of about EUR 560 Million

Erste Group expects to post net profit of approx. EUR 560 million in Q2 16, raises guidance for 2016 to ROTE >12% (up from 10-11%).

July 14, 2016

Closing of Visa Takeover Brings EUR 97 Million Pre-Tax Profit to RBI

The expected pretax profit from the cash payment of the transaction will be EUR 97 million. It should be booked under net income from financial investments in the second quarter of 2016. Visa Inc. had announced the takeover of Visa Europe Ltd. in November of 2015. The cash payment of this one-off effect will be split between Slovakia, Romania, Czech Republic, Poland, the RBI head office, Croatia, Bulgaria, Hungary and Zuno.

June 21, 2016

Tax Payers to Finance AvW Bankruptcy after all?

Tax payers may have to finance the bankruptcy of Carinthian financial company AvW after all, Presse daily reports in its online issue. The damage is estimated at EUR 148 million (USD 168.2 million).

June 8, 2016

Bawag Laying Off Further 180 to 200 Employees

Bawag Bank will optimize its branches and in course of the process will cut 180 to 200 jobs. 70 to 80 of the affected employees are supposed to be sent back to their actual employers - Post AG.

May 3, 2016

RBI Not to Sell Zuno Bank to ABH Holdings

The sale of Raiffeisen Bank International’s (RBI) direct bank Zuno to the Alfa Banking Group will not be concluded because ABH Holdings withdrew from the contract of sale.

March 1, 2016

Erste Group Provides Blackstone with a 5-Year EUR 91 Million Facility

Erste Group provides Blackstone with a 5-year EUR 91 million facility to acquire 12 logistics assets. The 265000 sqm portfolio covers 12 standing logistics investments located in Hungary (5), Romania (4), Poland (2) and Slovakia (1), as well as land reserves.

February 22, 2016

Unicredit Bank Austria Preliminary Results: Net Profit of About EUR 1.3 Billion for 2015

Unicredit Bank Austria has published its preliminary results for the 2015 financial year. Unicredit's Austrian subsidiary posts a net profit of about EUR 1.3 billion for 2015. Systemic charges including bank levies are up by EUR 89 million to EUR 326 million.

February 10, 2016

UniCredit Final Restructuring Program on Bank Austria's Retail Business

UniCredit announced a major step in its strategic plan execution, by launching a profound restructuring program on its Austrian retail business that will enable Bank Austria to develop its business in a sustainable way, while bringing down significantly its cost income ratio. The restructuring plan will allow to reduce by 2018 Bank Austria's overall costs by € 150mn per year on an ongoing basis on top of the Strategic Plan and with main focus on personnel expenses, leading to an overall cost decrease by almost € 300mn versus 2014 in order to ensure the business sustainability in the long-run.

December 15, 2015

Large Securitisation Deal between EIB and UniCredit Leasing Austria

EIB participates in securitisation transaction of UniCredit Leasing Austria with EUR 230.9 mil. The European Investment Bank (EIB) will make available EUR 230.9 million to UniCredit Leasing Austria through the purchase of asset-backed securities (ABS).

November 24, 2015

Hungarian Central Bank Buys Austria's 68.8% Stake in Budapest Stock Exchange

Austrian shareholders CEESEG and OeKB sell their 68.8% stake in Budapest Stock Exchange to Hungarian Central Bank for €42m ($45m), the Hungarian central bank confirmed officially.

November 24, 2015

VIG Completes Acquisition of Latvian Non-Life Insurer Baltikums AAS

Vienna Insurance Group (VIG) has finalized the 100-percent acquisition of Riga-based Baltikums AAS. As a result of the acquisition, Vienna Insurance Group is now one of the top five insurers on the Latvian market.

October 27, 2015

Meinl Bank: Stephen Coleman to Become New CEO

Stephen Coleman will replace Günter Weiss, who must vacate his seat due to a ruling from the Austrian Financial Market Authority (FMA).

October 23, 2015

Erste Group Presents Net Profit of EUR 487.2 Million in H1 15

Erste Group closed the first half of 2015 with positive results, reflected in strong improvements in profitability, asset quality, lending and capital. The group reported a net profit of EUR 487.2 million in H1 2015, compared to a negative result of EUR -929.7 million in the similar period last year; all countries except Hungary made a positive contribution to this development. Total assets increased to EUR 197.5 billion, compared to EUR 196.3 billion at the end of 2014. This balance sheet growth reflects a 2.2% advance in net lending to customers compared to the end of 2014, to EUR 123.5 billion, supported by the 1.7% growth in loans to households, 2.0% to SMEs and 5.9% to large corporates.

August 7, 2015