Huawei's 5G Network Technology in Austria: Systemic Rival at the Gate to Europe

While all eyes in Europe are focused on the Russia-Ukraine side conflict, the true war is raging elsewhere, namely in network technology between China and the West. This technology war is about nothing less than the global security-technological leadership role of the next decades, and thus about the decisive question of whether the Western democratic world order can assert itself or whether the Chinese authoritarian system with totalitarian surveillance will prevail. Due to its relative weakness, Austria plays an important and central key role in this process. While most Western countries are increasingly and decidedly resisting the deployment of the 5G network infrastructure largely supplied by Huawei and ZTE - which are intricately owned and substantially controlled by the Chinese Communist Party - there are quite a few telecom providers in Austria who are using and even expanding this technology, primarily because their economic survival is already dependent on this technology, and secondly because the Austrian state is largely toothless and ignorant in the face of the push by the Chinese equipment suppliers and their lobbyists.

Much of the discussion about the dangers associated with China gaining dominance in 5G has focused on the immediate security concerns of using communications networks that China can monitor and control. / Picture: © Wikimedia Commons / No machine-readable author provided. Martin-D assumed (based on copyright claims)., CC BY-SA 2.5

Much of the discussion about the dangers associated with China gaining dominance in 5G has focused on the immediate security concerns of using communications networks that China can monitor and control. / Picture: © Wikimedia Commons / No machine-readable author provided. Martin-D assumed (based on copyright claims)., CC BY-SA 2.5

![Headquarters of Huawei Technologies Co., Ltd. in Shenzhen, China<small>© Wikimedia Commons / Brücke-Osteuropa [Public Domain]</small>](https://www.vindobona.org/images/gallery/64750/gallery_news64750_image1-big.jpg)

What is 5G all about?

5G technology, the framework for which is just emerging around the world, will be of central importance for the unforeseeable future, dominating the technological and industrial world.

Communication networks will no longer serve only for communication, but will become the central nervous system of the next generation Internet.

The industrial Internet, the Internet of industrial systems will depend on this technology. The Industrial Internet powered by 5G will create 25 trillion euros of new economic opportunities over the next 5 years.

5G will enable a revolution in industrial processes, and it is not comparable to previous technological achievements. Above all, it is not comparable to the transition from 3G to 4G in our wireless networks. The transition from 3G to 4G meant that download speeds increased from one Mbps to about 20 Mbps. This speed improvement allowed for data storage, increased download speeds for movies and websites, and the shift of processing power from devices to the so-called cloud. This stage of mobile business development spawned numerous new businesses, applications and fields of innovation.

With the 5G revolution of industrial processes, however, we are talking about a quantum leap, about a change that will dwarf the development step from 3G to 4G many times over. Peak rates of several gigabits per second, both download and upload, will be available. These fiber-like speeds mean that 5G will have extremely low latency of less than 10 milliseconds. With this capacity, the smallest devices can be connected virtually instantaneously and access infinite computing power. With these features, 5G technology will become a precise command, control and monitoring system for managing industrial processes in real time.

5G technology will make all things smart, not only smart refrigerators, but also smart homes, buildings, factories, and transportation systems.

Diverse devices and sensors that collect, analyze, transmit data and execute remote commands will be embedded in industrial equipment across a wide range of industries, including healthcare, agriculture, transportation, energy, finance and heavy construction. Entirely new technologies and opportunities in "Internet of Things (IoT)", artificial intelligence (AI), robotics, quantum computing, nanotechnology, biotechnology, autonomous vehicles, energy storage, and will be interwoven with the Internet.

The centrality of 5G technology and the threat posed by China's aspirational dominance in this field

China has gained a lead in 5G over the past 20 years, capturing 40 percent of the global 5G infrastructure market.

For the first time in history, neither the United States nor Europe is leading the next era of technology.

Much of the discussion about the dangers associated with China gaining dominance in 5G has focused on the immediate security concerns of using communications networks that China can monitor and control.

If China achieves sole dominance of 5G, it will be able to dominate the opportunities presented by a breathtaking array of emerging technologies that will depend on and be interwoven with the 5G platform.

From the perspective of each country's national security, if the industrial Internet becomes dependent on Chinese technology, China could cut off countries from technologies and devices on which their consumers and industries depend.

The United States along with some Western partners developed the predecessor technology, 4G, and therefore was able to claim most of the economic opportunity that came from that technology.

5G is an infrastructure business. It relies on a radio access network (RAN). China has two of the leading RAN infrastructure providers: Huawei and ZTE. Together, they have already captured 40% of the market and are aggressively pursuing the rest. Huawei is now the leading provider on every continent except North America. China's main competitors are Finland's Nokia (with a 15% share ) and Sweden's Ericsson (also with a 15% share ). The remaining equipment suppliers are as follows: Cisco (6%), Samsung (3%) and Ciena (3%).

The Chinese are pulling out all the stops to expand their 5G market share around the globe. It is estimated that the total market for 5G infrastructure is worth 80 billion euros. China is offering incentives of more than 120 billion euros to help customers finance the purchase of its equipment. This means that the Chinese can offer customers to build their 5G networks without a down payment.

In an infrastructure business like 5G, scale is critical. The business requires huge investments in research and development, as well as very high capital costs. The larger a company's market share, the better it can afford these costs. It is more difficult for competitors facing a shrinking market to make the investments needed to compete.

Chinese companies start with the advantage of the largest domestic market, which gives them immediate economies of scale, and as they expand that globally, they can invest more in their technology.

The challenge is, the more China gains traction as a 5G infrastructure provider, the more it will gain traction in all of the technologies that form the foundation of 5G infrastructure.

5G is based on a number of technologies, including semiconductors, fiber optics, rare earths and materials. China is keen to produce all of these elements itself so as not to be dependent on foreign suppliers. In recent years, it has taken control of many of these rare earth elements, especially in Africa and South America.

Semiconductors are a good example of the impact of China's leadership in 5G. China now consumes more than half of the world's semiconductor production. China has now begun replacing U.S. semiconductors with its own. Its size in this area will allow it to make the necessary investments to close the current quality gap. As China expands its size in the semiconductor industry, it will put considerable pressure on alternative suppliers. And, of course, semiconductors are essential not only for 5G, but also for a wide range of other technologies and industries. It is not only against this background that the European Commission has just unveiled its draft for the European Chips Act.

Within the next few years, global 5G territory and application dominance will be determined. The critical question is whether, within that window of time, the West can give Huawei enough competition to retain and recapture enough market share to maintain the kind of long-term and robust competitive position necessary to avoid ceding dominance to the Chinese.

Even the previous U.S. ambassador to Vienna, Trevor Traina, repeatedly warned of the dangers of dependence on Chinese network infrastructure suppliers. Now this task lies with the new U.S. ambassador, Victoria Reggie Kennedy.

What is Huawei and why is Huawei so controversial?

Huawei, a Chinese multinational information technology and consumer electronics company and supplier of telecommunications equipment, has invested heavily in 5G, the fifth-generation wireless technology that will connect self-driving cars and other complex digital systems to the internet.

It is true that the group's enormous pace of innovation and growth is frightening enough for some.

But much more decisive from the critics' point of view is that Huawei is formally privately owned, but practically comes from a state in which political interference is common, even in non-state-owned companies.

There is no functioning rule of law that protects individuals or companies from such interference, and it is considered certain that no Chinese company can escape state pressure. This also applies to demands by intelligence services.

Washington says putting Huawei gear into these systems would create a national security threat because the Chinese government could use Huawei gear to eavesdrop or launch a cyberattack.

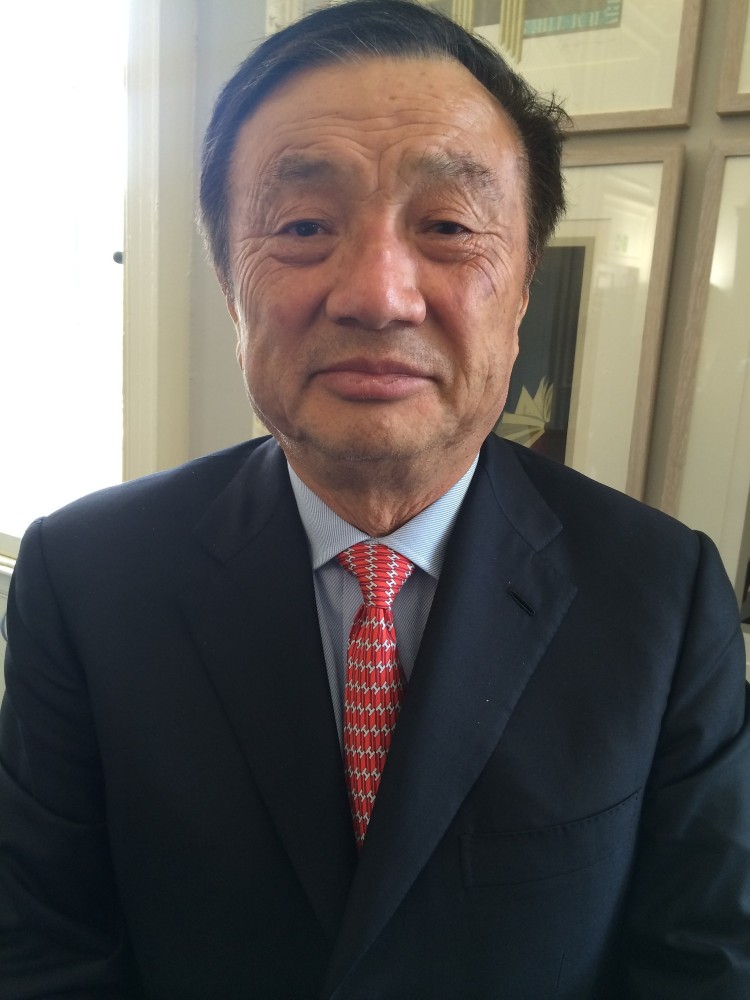

Officials and politicians within the federal government have raised concerns that Huawei-made telecommunications equipment may be designed to allow unauthorised access by the Chinese government and the Chinese People's Liberation Army, given that Ren Zhengfei, the founder of the company, served as an engineer in the army in the early 1980s.

Huawei has become the target of a US campaign to bar its gear from many global markets. It has faced numerous criticisms for various aspects of its operations, particularly in regards to cybersecurity, intellectual property, and human rights violations.

Huawei has faced allegations, primarily from the United States and its allies, that its wireless networking equipment could contain backdoors enabling surveillance by the Chinese government. Huawei has stated that its products posed "no greater cybersecurity risk" than those of any other vendor, and that there was no evidence of the U.S. espionage claims. It said, that in the company’s 30-year history, no evidence has ever shown its gear to be less secure than equipment made by Ericsson, Nokia, or Samsung.

The US has barred Huawei from selling to large US telecom operators and is pressuring its allies to exclude the company’s equipment from their 5G networks.

These concerns intensified with Huawei's involvement in the development of 5G wireless networks, and have led to some countries implementing or contemplating restrictions on the use of Chinese-made hardware in these networks. In March 2019, Huawei sued the U.S. government over a military spending bill that restricted the purchase of equipment from Huawei or ZTE by the government, citing that it had been refused due process. Huawei exited the U.S. market due to these concerns, which had also made U.S. wireless carriers reluctant to sell its products.

Huawei has also faced multible allegations that it has engaged in corporate espionage to steal competitors' intellectual property, and in 2019, was restricted from performing commerce with U.S. companies, over allegations that it willfully exported technology of U.S. origin to Iran in violation of U.S. sanctions.

The company has also been accused of assisting in the mass-detention of Uyghurs in Xinjiang re-education camps, and employing forced Uyghur labour in its supply chain. Huawei has consistently denied that it threatens anyone.

Huawei’s opponents say that regardless of its intentions, Chinese law would force the company to insert backdoors in its network gear if the government ordered it to do so.

What are the alternative vendors to choose from?

Realistically, there are only three alternative companies that can currently compete with Huawei as 5G infrastructure providers: Nokia, Ericsson, and increasingly Qualcomm. They have high-quality, reliable products that can guarantee performance. They have proven that they can successfully manage the migration of customers from 4G to 5G. The main problem with these vendors is that they do not have the scale of Huawei, nor do they have the support of a powerful country with a large market like China.

1. Ericsson Telefonaktiebolaget LM Ericsson is a Swedish telecommunication equipment and services company with a market capitalization of €25 billion. The company operates at the forefront of 5G hardware development, participating in field trials and research programs with mobile operators around the world, including Verizon, AT&T, China Mobile, and South Korea's SK Telecom Company Ltd., among many others.

2. Nokia Nokia Corporation is a Finnish telecommunications equipment and data networking company with a market capitalization of €18.5 billion. Like Ericsson, Nokia has entered advanced testing phases on new 5G radio access products for eventual deployment by mobile operators around the world. It has ongoing collaborative research and testing programs with Verizon, China Mobile, SK Telecom, Japan's NTT Docomo Inc., and Deutsche Telekom AG, among others.

3. Qualcomm California-based Qualcomm Inc. develops and commercializes wireless communication technologies, including the 3G CDMA standard and the 4G LTE standard. In addition to licensing intellectual property associated with these technologies, the company also develops and produces software and integrated circuits (chipsets), which are used in wireless network equipment and mobile devices.

What is the specific situation in other countries?

United States

The United States has, for several years, been warning that Huawei represents a security risk to the interests of the U.S. and its allies.

Despite the company’s claims to the contrary, U.S. officials say they believe the company has close ties to Chinese state security agencies and that its telecommunications products could be used to gather information on, or disrupt the activities of, China’s rivals.

Officials also point to a law in China that obligates private companies to cooperate with government agencies in the collection of data deemed important to state security.

In 2019 and 2020, the U.S. began aggressively moving against Huawei on a number of fronts. The Trump administration fought against the company’s effort to market the networking equipment necessary to roll out 5G wireless technology.

The U.S. declared, among other things, it would cease sharing intelligence with allies who allow Huawei to supply critical pieces of their nations’ telecommunications infrastructure, arguing the company presentedfor use in new phones made by the company. Intel and Qualcomm, two major makers of microchips, were banned from selling their most advanced technology to Huawei. The ban extended to contract chipmakers, like Taiwan Semiconductor Manufacturing Corp., the world’s largest.

In March 2021, the Biden administration amended licenses for companies to sell to China's Huawei Technologies Co Ltd, further restricting companies from supplying items that can be used with 5G devices. The changes could disrupt existing contracts with Huawei that were agreed upon under previous licenses that have now been changed. The actions show the Biden administration continues to reinfore a hard line on exports to Huawei. The initial export licenses were granted by the Commerce Department after the company was placed on the department's trade blacklist in 2019. The new conditions make older licenses more consistent with tougher licensing policies implemented in the waning days of the Trump administration.

United Kingdom

The exited UK has taken Huawei out of the nation's 5G infrastructure. Britain is among the countries that, because of security concerns, have begun removing Huawei equipment that had already been installed. The UK is to rely more on 5G technology from Samsung in South Korea and NEC in Japan, which have so far played only a minor role in the global market for 5G equipment. This is also intended to reduce dependence on the two 5G technology providers from the European Union, Ericsson and Nokia.

Germany

When it comes to building 5G data centers for data transmission, Chinese suppliers such as Huawei and ZTE are left out in Germany, Handelsblatt reports.

Vodafone announced a contract for the so-called core network with the Swedish group Ericsson, with a term of five years. The other two German network operators Telefónica and Deutsche Telekom also do not rely on Huawei.

In the antenna network, however, which only includes the antennas and does not involve data processing, the situation is different: Vodafone and Deutsche Telekom work with Ericsson and Huawei here, while Telefónica has contracts with Nokia and Huawei.

After a long political debate about security concerns against Huawei and other technology groups from China, the federal government had set strict certification requirements. According to these, Chinese providers such as Huawei and ZTE can also participate in the 5G rollout. However, there is a kind of political veto right when it comes to certification by German authorities. That was perceived in the telecommunications industry as a factor of uncertainty for the company's plans.

Competitors have taken a similar course:

- Telefónica, with its O2 brand, is installing technology from Ericsson in its core network, as well as equipment from Huawei and Nokia in its antenna network.

- Deutsche Telekom says it relies on European and American manufacturers for the core network and on Ericsson and Huawei for the antenna network. The reason given for the choice of suppliers for the antenna network is that with the energy-saving SRAN technology, 5G components can only be placed on top of 4G components from the same manufacturer.

- United Internet with its subsidiary 1&1 Drillisch is also in the starting blocks. The company wants to plan the new network without Chinese providers.

Situation in Austria: No clear statements from the Austrian government

Basically, there is little or nothing to be heard from the Austrian government on the subject of 5G technology.

The choice of suppliers is left to the mobile network operators, who must, however, pay attention to security and data protection, according to "Der Standard" on the subject of Huawei from the responsible Ministry of Agriculture.

In 2018, Minister of Economy, Margarete Schramböck, traveled to Huawei in China.

In September of the same year, former Federal Chancellor Sebastian Kurz and again Minister for Digital and Economic Affairs, Margarete Schramböck, traveled to Huawei in Southern China to discuss ICT infrastructure build-out and digital transformation with Huawei Rotating Chairman, Guo Ping, and outlined the company's plan for increased R&D collaboration with Austria.

Nevertheless, in 2020, Sebastian Kurz stated in response to a Neos parliamentary question that he had "no knowledge" of whether there had already been any suspected cases of cyber espionage or similar security risks in Austria with 3G and 4G equipment from Huawei and similar Chinese companies.

As revealed in February 2019, Huawei Austria also sponsors the ACBA Austrian Chinese Business Association, among others.

"Multi-vendor strategy" according to Rundfunk und Telekom Regulierungs-GmbH (RTR).

The telecom authority responded to concerns about the deployment of 5G technology by presenting its proposal on the security of 5G networks in April 2020. Specifically, it presented its regulation, which entered into force in June 2020. "This sets out minimum security measures for all operators of electronic communications networks and services, such as information obligations in the event of security incidents. To ensure security in 5G networks, mobile operators must rely on a "multi-vendor strategy." They should only buy the necessary technical equipment if it is available from several suppliers. This is to avoid dependencies on a single supplier." the statement continues, according to "Der Standard".

With the adoption of the Telecommunications Act, Austria has set the course for 5G network expansion

On November 1, 2021, the new Austrian Telecommunications Act (TKG 2021) came into force.

Unlike other EU countries, Austria is also relying on cooperation with the Chinese manufacturer Huawei.

The amendment attempts to put the legal basis for the expansion of the 5G network in Austria on a new footing. Austria wants to enable nationwide coverage with 5G by 2027.

This finally replaced the legal framework that had been in place since 2003. The main intention of the new version was to implement the European Electronic Communications Code. Particular emphasis was placed on network security, the use of third-party infrastructure and consumer protection.

The importance of the technical security of communications networks for digitization is taken into account comprehensively. An Advisory Board for Security in Electronic Communications Networks consisting of 13 members will be established. This advisory board will be tasked with quickly answering questions about suspected or actual high risks posed by certain network elements for information security or data privacy in our networks and providing an objective and well-founded basis for necessary political decisions. To what extent the new additional regulations will replace the previous toothless approach remains to be seen.

Austria already specified in its 5G strategy in 2018 that 5G expansion should be driven forward through close cooperation via research and economic cooperation with Asian countries, including China.

Praise for the Austrian law also came from Huawei itself. Huawei's Vice President for Central and Eastern Europe, for example, stressed that the Austrian law would strike the right balance between high security standards on the one hand and preserving competition in the market on the other.

While elsewhere network operators have excluded Huawei from their core network, Austrian network operators still use Huawei equipment.

In Austria, however, the issue surrounding a potential security risk from Huawei has not made big waves.

When the amendment to the Telecommunications Act was passed in the National Council, the issues were not even discussed.

Major points of criticism remain:

- Although the amendment to the Telecommunications Act also introduces a monitoring system for high-risk suppliers, it only implements the minimum standards of the EU 5G Toolbox, which attempts to mitigate potential risks in the 5G network rollout.

- While most other EU countries have chosen a much more confrontational course towards Chinese suppliers such as Huawei, Austria relies on a non-political expert advisory board to assess the risk of certain suppliers. This will produce a perception report on any high-risk suppliers every two years to "ensure an objective basis for decision-making."

- A specific country of origin or ownership structure alone is not a criterion for exclusion. The criteria are applied equally to all suppliers.

Magenta (formerly T-Mobile)

Huawei has made the breakthrough by already building a 5G network in Austria for mobile operator Magenta.

It is the first commercially deployable 5G core network in Europe, Huawei has stressed.

However, no Huawei products are reportedly being used in the core network.

In an interview with "Der Standard" in February 2020, Andreas Bierwirth, the CEO of Magenta Telekom, said that his company was betting on Huawei, but that cooperation was a "difficult issue" in which political and populist influences played a major role.

Its 5G network, which currently includes 58 sites in 33 municipalities, was built by Huawei. He said it has not yet been decided whether Huawei will be a player in the further 5G rollout. If Huawei is not entrusted with it, Magenta would probably have to dismantle its current 5G network and replace it with a new one. The dismantling would also be necessary because a system from another provider is difficult to make compatible. Switching to a different network supplier would be a considerable expense. Huawei products would already be dispensed with in the core network, the heart of the 5G network, but not in the antennas. However, these would not be so critical either. In any case, coordination with the parent company in Germany would take place.

In July 2020, Magenta finally announced in a press release that it had stayed with Huawei because doing without Huawei hardware would cost Magenta a lot of money and the 5G network had been massively expanded.

They would stay with Huawei because the fourth generation of mobile communications, 4G (LTE), and 5G are technically based on each other, and it is comparatively easy to upgrade existing LTE technology from Huawei to 5G. However, Huawei products would not be used in the core network. Since the lax regulation of the Austrian Regulatory Authority for Broadcasting and Telecommunications (Rundfunk und Telekom Regulierungs-GmbH) only requires mobile operators to use technology that is also available from other manufacturers when setting up their 5G networks, they do not feel compelled to act, since hardware from other suppliers (Ericsson and Nokia) is also used.

A1 Telekom Austria

Telekom Austria has 25 million customers across Austria, Bulgaria, Croatia, Belarus, Slovenia, Republic of Serbia and the Republic of North Macedonia.

According to Reuters, A1 Telekom Austria Group, a unit of Carlos Slim's America Movil, was open to considering Chinese vendors such as Huawei and ZTE for upcoming 5G networks in several countries.

It says that "Telekom Austria has not seen any pressure in most of the European countries it operates in."

"For us it is very important to have markets where we have Chinese vendors to test the performance of the different networks in real time," Chief Operating Officer Alejandro Plater told Reuters.

"Not only is Chinese technology cheaper, but it offers features that are better than their European counterpart, making it competitive," he continued.

"We have launched 5G in Austria, Bulgaria and we will launch in Slovenia any time, and for other countries we are still waiting to get the spectrum," Plater said.

Hutchison DREI Austria from Hong Kong

Hong Kong Chinese mobile operator "3", a wholly owned subsidiary of CK Hutchison Holdings, is deploying ZTE's 5G network.

Liwest Cable Media Ltd.

Liwest, a telecommunications company based in Linz and the largest cable network operator in Upper Austria, currently serving over 125,000 households, also continues to rely on Huawei.

Summary

While most of the Western world has understood that the future depends not only on climate issues, but also quite significantly on the ideological world order we live in, and that control over network technology is the key determinant of the direction we take, Austria is letting itself be wrapped around its finger by the Chinese Communist Party in the form of its network infrastructure suppliers Huawei and ZTE, supported by profit-oriented telecom companies, by their lobbyists, and by clueless and disinterested politicians and civil servants.